Activate your Fora Financial account via https://www.forafinancial.com/activate and enter activation code to activate your Fora Financial account in less than one minute.

Activate Fora Financial Account on Mobile or Desktop Computer via forafinancial.com/activate/

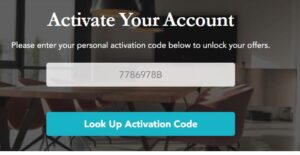

- Visit the page at https://www.forafinancial.com/activate/.

- Enter your personal activation code below to access your benefits.

- After that, click “Look Up Activation Code.”

- When the code is verified, the account will be activated.

Activate Fora Financial Account via Phone Number

You can also activate your Fora Financial account via customer support service phone number 1-855-326-8525 and verify your identity and follow their instruction to activate your account through an activation code.

Note – Before calling the Fora financial support, make sure you have all the documents with you to verify your identity.

Why would you pick Fora Financial?

- Easy application process: Fora Financial offers a simple and streamlined application process that can be completed online in just a few minutes.

- Quick funding: Once you are approved for a loan, Fora Financial can provide funding in as little as 72 hours, which can be crucial for businesses that need to move quickly to take advantage of new opportunities.

- Flexible loan options: Fora Financial offers a range of loan options, including merchant cash advances, short-term loans, and lines of credit, so businesses can choose the financing option that best fits their needs.

- No collateral required: Fora Financial’s loan options generally do not require collateral, which can make it easier for businesses to qualify for funding.

- Dedicated customer service: Fora Financial prides itself on providing excellent customer service, with dedicated account managers who work closely with businesses to understand their needs and help them achieve their goals.

- Business education and resources: Fora Financial offers a range of educational resources and tools to help businesses manage their finances more effectively and make better decisions about their operations.

Overall, Fora Financial may be a good option for small businesses that need financing to grow and expand and are looking for a fast, flexible, and customer-focused financial services provider.

- Easy to use

Companies and banks often require a lengthy and complicated credit application process. This can often cause frustration and exhaustion for the applicant. Fora Financial’s easy one-page application, along with a few months of bank statements, makes it possible to get approval within 24 hours.

- Get funding faster.

Many banks can make it difficult to get credit, despite the speed of the application. The money will need to be obtained over time. However, it can sometimes be difficult. Fora Financial can provide capital in 72 hours. This is faster than a bank loan.

- Security

Money is always a source of concern. Fora Financial is able to give you the assurance of trust. It is seamless, secure, transparent, and easy to use. You can even track your progress in real-time to see if you are available for funding. This makes all the features at forafinancial.com/activate compelling enough to warrant activation.

- No application fees

- Terms and rates

Optional Funding

- Small Business Loan

Fora Financial can approve small business loans ranging from $5,000 to $500,000 within as little as 24 hours. Our easy loan application process is based on a couple of bank statements, not lengthy paperwork and complicated financial data. In a matter of minutes, you’ll be able to access the funds in your company bank account!

- Working capital starts at $5K to $500K.

- There are no limitations on usage.

- 24/7 availability for approval

- free, no-obligation quote

- terms as long as 15 months

- Early payoff discount

- No collateral is required.

- Approval does not have to be solely based on credit.

- Merchant Cash Advance

The merchant cash advance service is designed to work at the speed that your company operates. It’s easy to understand: we buy your company’s next credit card transactions, and then your remittance will be dependent on how your company’s revenues fluctuate. In addition, our dedication to small businesses means that you could get up to $5,000—or even $500,000!

- Working capital of $5K-$500K

- No set terms

- 24/7 availability for approval

- Early payoff discount

- There are no limitations on usage.

- Approval is not solely based on credit.

- free, no-obligation quote

Important details about the Loan.

Before applying, it is essential that you create a detailed business plan. Include information about the company, including its founder’s date, earnings for previous years, and monthly sales figures.

You may be required to provide the following documents depending on the lender:

- Statement of purpose

- individual credit report

- Previous legal names and criminal records

- Locations that were previously visited

- Documents relating to finance

Next, gather all licenses, permits, and certifications that your company has. Include everything that proves your ownership, such as:

- The Schedule C

- Incorporation documents

- Certificates of ownership

- Articles of incorporation

Most lenders will require financial documents as part of your application.

- Statements of accounts

- Statements on financial statements for a range of time periods

- Return on investment (ROI)

- Receivables (accounts that can be accessed)

- Receivables and accounts payable

You should also consult at least one credit union to discuss your personal and company credit scores. It is important to know your credit score before applying for a loan. This could impact the terms and conditions of the loan.

If your credit score is less than 600, it may be difficult to get financing.

Your interest rates and terms will be affected if you don’t disclose any debts. Create a business debt plan detailing all obligations, credit amounts, monthly payments, and credit amounts. If you show that you are serious about repaying your debt, lenders will be more likely to lend to you.

If your company leases or owns the property, please add the following information:

- Rent/real estate schedule

- Documentation on percentage ownership

- The amount of taxes that were paid

- The monthly payments are made.

- Other information that might be useful in the development of your application

Fora Financial Customer Service

- Call: 1-855-326-8525

- Email: customerservice@forafinancial.com

Fora Financial Contact Details

Sales Inquiries

(877) 514-8062

sales@forafinancial.com

Renewals

(888) 221-6031

renewals@forafinancial.com

Customer Service

(855) 326-8523

customerservice@forafinancial.com

Marketing & Press Inquiries

(855) 515-2413

marketing@forafinancial.com

Accounting

accountspayable@forafinancial.com

Job Inquiries

(212) 947-0100 x426

resumes@forafinancial.com

FAQs

Is Fora Financial real?

Fora Financial, a New York-based online lender provides access to small-business cash loans and advance cash to merchants. Fora Financial may be an ideal choice for businesses seeking short-term working capital, and businesses that aren't eligible with traditional banks for financing.

How do I get approved for financial fora?

You'll require a minimum credit score of 500 and no bankruptcy on your credit report in the past year.

How long does it take to be approved for financing?

After you have completed an application, many lenders will allow you to track the status of the loan online. However, the length of time required to obtain a loan varies depending on the lender type. Credit unions and banks are expected to receive funds within between one and five days in the event of requesting loans at an institution like a bank or credit union.

How do I get a business loan?

Entrepreneurs need small business loans to start, grow, and maintain a business. Online small business loans may be possible with many lenders who have simpler criteria and quicker applications.

Small businesses dominate the economy of the United States. According to the Small Business Administration (SBA), there are more than 32 million small businesses in America. Regardless of their differences, they all depend on financing from companies.

What are the most popular types of company loans?

Business Lines of Credit

Equipment Financing

Long-term

SBA

Finance for Accounts Receivable

Working Capital

Short term

What are the steps in the loan process?

It is important to determine the amount and the terms of the loan.

Assess your creditworthiness.

You must ensure that you are able to repay the company loan.

Apply for a loan for your business.

Order your financing.

How capital can help you?

You can use your funds to pay for everything your business requires.

Upgrade to new technology.

Employ more staff to handle the growth in business.

Avoid penalties by paying your taxes on time.

Revitalize your business to bring in new customers.

Advertise and market to increase your customer base.